Fiscal space

In view of multiple crises, state agencies must stay able to invest in crucial infrastructure and services

Excessively tight budgets

Humankind is facing a polycrisis. The challenges that governments must rise to include disease control, global heating, food insecurity, the fallout of the Ukraine war, the erosion of ecosystems, high energy prices and violent strife. In many places, public budgets were strained even before the start of the Covid-19 pandemic. Several sovereign nations are now heavily indebted, but even those that are not tend to struggle to mobilise the funds they need to tackle urgent problems.

Achievement of the sustainable development goals requires considerable investments. Not least, social-protection systems must be expanded. To widen governments' fiscal space, it is essential to raise sufficient taxes. At the same time, excessive debt must be restructured. Both issues require international cooperation.

Recent articles

New contributions on fiscal space

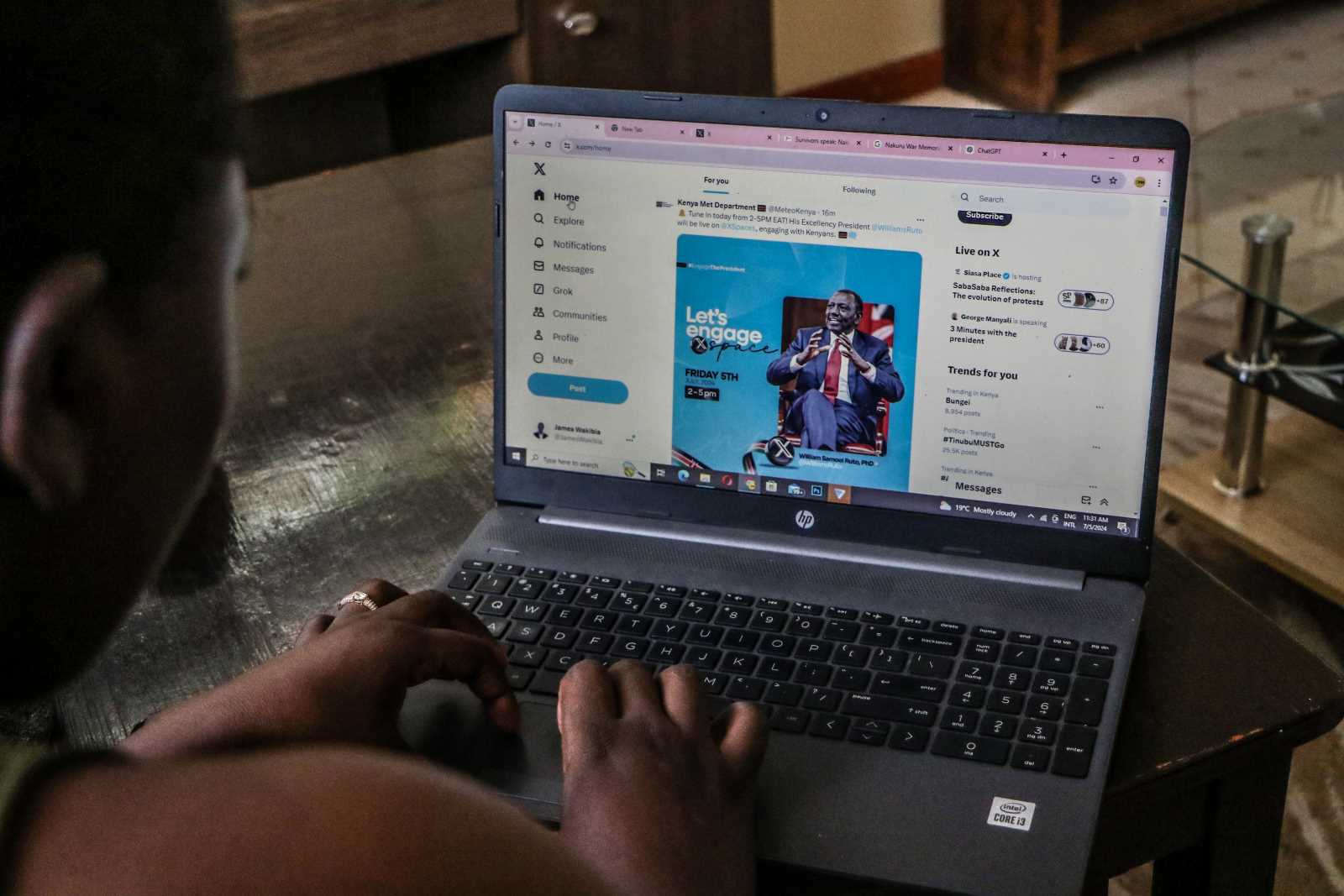

D+C/E+Z regularly reports on government action within tight budget constraints, national debt, currencies and the international financial market. Here you can find current articles related to the topic.

Fundamental challenges

Making the most of public finance

The G20 summit in Indonesia in November 2022 took stock of a host of global challenges. The leaders of the most important national economies assessed matters and made incremental progress. Quite evidently, more needs to happen. It is indispensable to increase tax revenues. High interest rates in prosperous nations are compounding problems in the disadvantaged world. Nonetheless, central banks can play their part in facilitating indispensable investments in climate adaptation and mitigation, for example.

Boost social protection

Reducing people’s vulnerability

Global shocks are increasingly plunging people into poverty. Countries with low and lower middle incomes must cope with difficulties they have not caused. Social protection systems are needed to protect vulnerable communities. Such systems are essential for eradicating poverty and ending hunger as aspired in the SDGs.

Multilateral debt management

How to tackle the debt crises

As multilateral agencies have been acknowledging for several years now, sovereign-debt problems are growing and becoming unmanageable in some countries. While the rhetoric of the World Bank and the International Monetary Fund has been quite progressive, the Fund’s stance towards individual countries has been less generous. It would make sense to create an international mechanism for dealing with sovereign default. The G20 have taken steps in the right direction, but more must happen. It has become increasingly obvious, moreover, that the conventional concept of official development assistance (ODA) is not fit for purpose in this era of polycrisis.

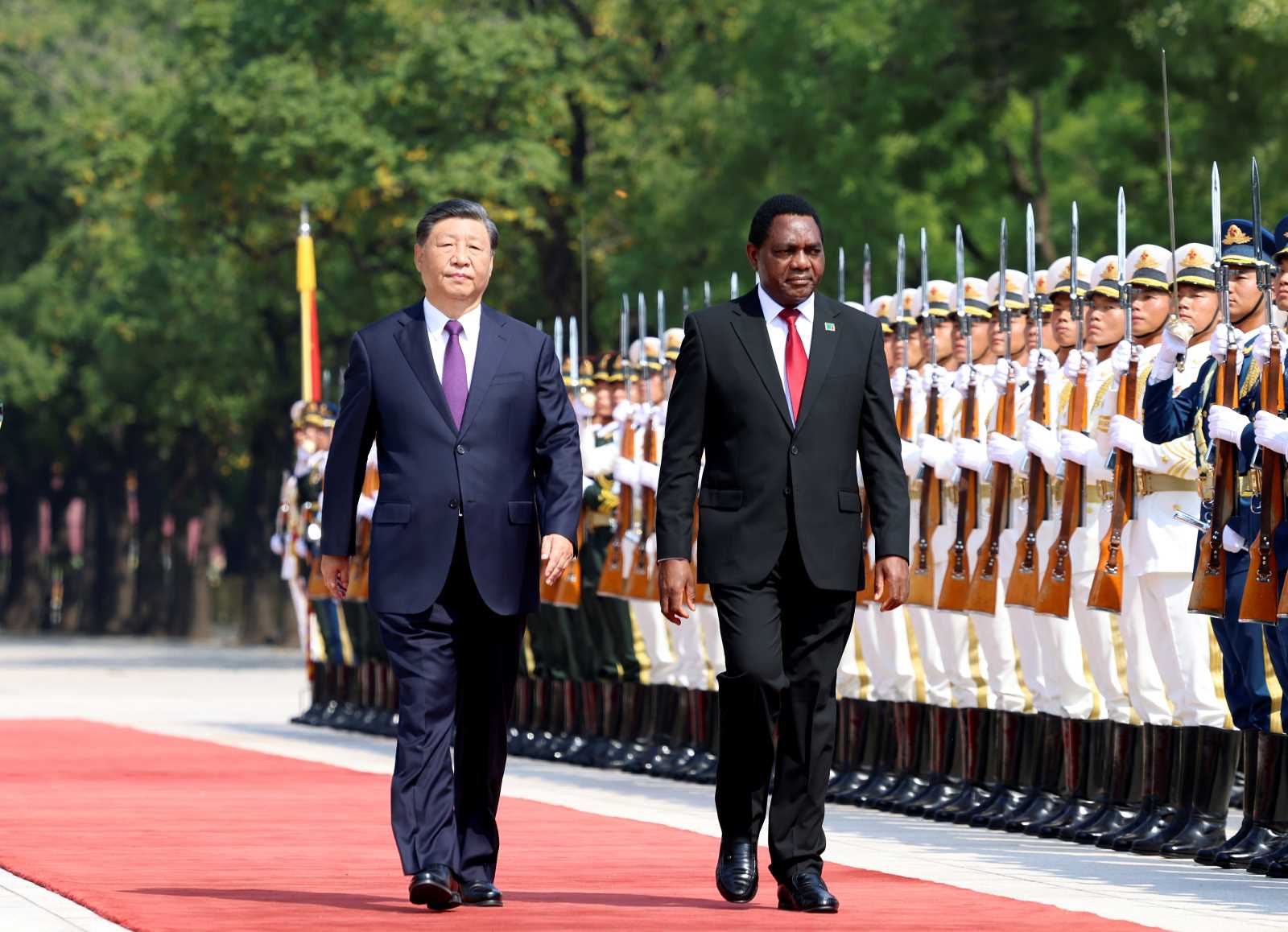

Debt scenarios in different countries

Struck by crisis: Sri Lanka, Zambia, Pakistan and others

Sovereign debt problems are haunting several countries. Three prominent examples are Sri Lanka, Zambia and Pakistan.

Digital Monthly on development finance

Digital Monthly on development finance

Our Digital Monthly 2025/03 focuses on how the development funding gap can be closed. Click on the title on the left to download the issue as a PDF free of charge.

The contributions of our authors deal, among other things, with

- how the USAID cuts would affect international development,

- voids that might be filled by the BRICS+,

- effects of development funding cuts on donor countries,

- the essential role of the private sector,

- the upcoming conference on Financing for Develoment (FfD4) and

- how FfD4 must adress international debt policy.