Financial justice

A global minimum tax rate for the super-rich

It has been widely recognised that progressive taxation is a fundamental element of democratic societies. A progressive tax system means that those who enjoy higher incomes and wealth contribute more to the provision of social and public goods, which are drivers of economic growth. It also strengthens social cohesion and confidence in democratic norms and institutions.

Yet, the available evidence shows that the wealthiest individuals generally pay a smaller share of their income in taxes than other social groups, a phenomenon known as regressive taxation. This applies regardless of country-specific tax systems and enforcement policies. Regressive taxation occurs when the income tax system fails to effectively tax these individuals. The civil-society organisation Oxfam estimates that, in Group of 20 (G20) countries, the top one percent of wealth now accounts for 31 % of total wealth, up from around 26 % in 2004.

G20 leaders’ proposal to tax the ultra-rich

The G20, which now actually comprises 21 members including the African Union, is currently considered the most important forum for international economic cooperation, and, in particular, tax reform. Brazil held the G20 presidency from December 2023 to November 2024. During that time, the country proposed a global wealth tax. The proposal was approved by consensus and included in the Leaders’ Declaration of the 18th G20 Summit in Rio de Janeiro in November 2024.

The G20 leaders stated (G20 2024): “With full respect to tax sovereignty, we will seek to engage cooperatively to ensure that ultra-high-net-worth individuals are effectively taxed. Cooperation could involve exchanging best practices, encouraging debates around tax principles and devising anti-avoidance mechanisms, including addressing potentially harmful tax practices.”

There are many policies that countries can adopt independently to increase the taxation of the wealthiest individuals. Nevertheless, international coordination is crucial to ensure an effective minimum tax rate for the super-rich. The G20 proposal promotes progressive taxation by making it more difficult for these individuals to evade and avoid taxation by shifting their assets globally. It also aims to reduce tax competition between countries – the so-called race to the bottom – and support the fight against inequality.

According to French economist Gabriel Zucman, the current effective tax rate of ultra-high-net-worth individuals is equivalent to 0.3 % of their wealth. A study led by Zucman and commissioned by the Brazilian government found that if the rate were raised to 2 %, $ 200-250 billion in tax revenue would be raised every year from about 3000 billionaire taxpayers globally. Including centi-millionaires would add another $ 100-140 billion.

Zucman’s proposal would not require a multilateral treaty. Implementing countries could adapt it using a range of domestic mechanisms, including a presumptive income tax, an income tax based on a broad notion of income or a wealth tax. National sovereignty would therefore be respected. Such flexibility in tax system design tends to encourage more countries to participate.

Tackling income tax failures

Nonetheless, Zucman claims that a presumptive tax is preferable because, as recent research shows, there is a considerable gap between the economic income and taxable income of the wealthiest individuals. The assumption is that billionaires who report low taxable income – and therefore pay little in income tax – earn an economic income that the tax system is not taking into account. Conversely, those who already pay two percent of their wealth in income tax would have no additional tax to pay. The proposed minimum tax for billionaires would thus simply compensate for income tax failures.

In 2021, over 130 countries committed to a common minimum tax of 15 % on multinational companies in an agreement brokered by the OECD. This agreement demonstrated that innovations in international cooperation previously seen as naively idealistic can be put into practice in a short time. It also made it easier for those countries to meet the technical and political requirements of the global wealth tax.

A major technical challenge to implementing Zucman’s proposal is measuring the wealth of ultra-high-net-worth individuals. However, since most countries have an inheritance tax, there are a number of methods that are already being used to achieve this. And since much of billionaires’ wealth is tied to their assets in multinational enterprises, country-by-country reports on these firms can be extremely helpful.

Expanding international cooperation

Given the incentives to conceal wealth, countries need to exchange more information. The decrease in banking secrecy over the years has favoured such cooperation. In addition, the multinational tax has increased transparency and helps to prevent the concealment of corporate assets.

However, the biggest obstacles to implementing a global wealth tax are geopolitical. Countries may resist having to change their tax systems in order to adopt a global common tax standard for billionaires. During the Rio de Janeiro G20 Summit, Argentine President Javier Milei threatened to reject any communiqué that included the wealth tax. The US under Joe Biden also showed reservations towards the proposal.

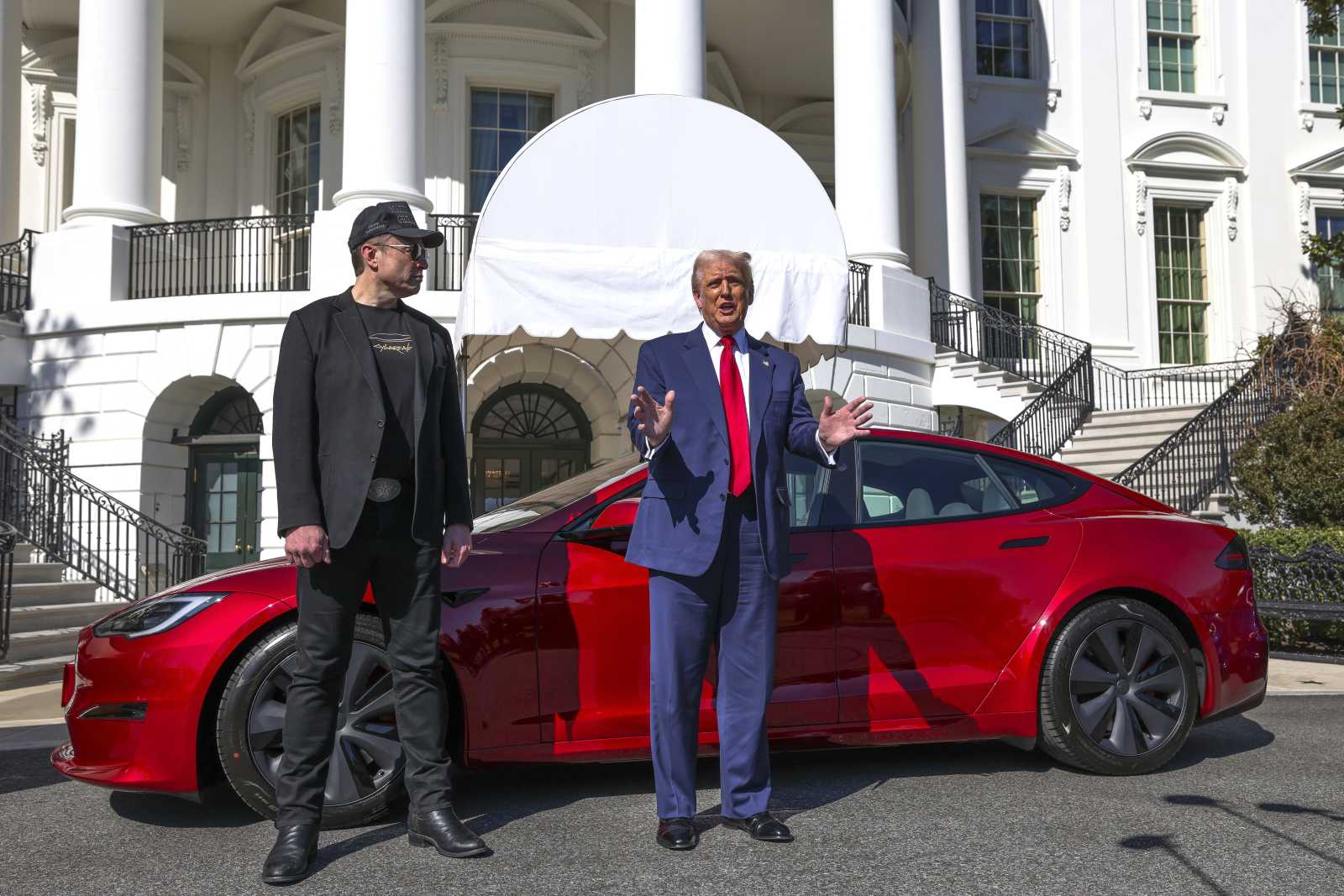

More importantly, since his inauguration earlier this year, US President Donald Trump has not only disavowed the OECD global multinational tax deal, but also threatened to retaliate against any country that complies with it by imposing the 15 % minimum tax on American corporations. As he relies on the support of big tech industry billionaires like Elon Musk, Jeff Bezos and Mark Zuckerberg, there can be little doubt that the current US president will do everything in his power to resist a global tax on the wealthiest individuals.

Link

G20 Rio de Janeiro Leaders’ Declaration, 2024:

https://www.gov.br/planalto/pt-br/media/18-11-2024-declaracao-de-lideres-g20.pdf

André de Mello e Souza is an economist at Ipea (Instituto de Pesquisa Econômica Aplicada), a federal think tank in Brazil.

X: @A_MelloeSouza