Sovereign debt

Sri Lanka has made important steps towards debt restructuring

Sri Lanka’s government went into default in April 2022. Several reasons contributed to making it unable to service its debts. On the one hand, there was the Covid-19 slump with the collapse of the important tourism sector and inflation because of higher prices for energy and imported commodities in general. On the other hand, it became obvious that successive governments run by members of the Rajapaksa family had used foreign loans for financially unviable vanity projects.

Sovereign default fast exacerbated the deep economic recession and triggered a political uprising. President Gotabaya Rajapaksa fled the country, but later returned. The Parliament chose Ranil Wickremesinghe as his successor. Poverty kept worsening, however. Vitally important goods became unaffordable for many people. Even those with sufficient purchasing power spent hours waiting in line, but sometimes unsuccessfully when supplies ran out.

The new head of state’s most important task was thus to restore economic stability. The challenge was particularly great because rather different groups of creditors had given Sri Lanka loans. Things had been easier around the turn of the millennium, when many developing countries struggled with over-indebtedness. At the time, the main creditors were multilateral and bilateral agencies, so when western governments finally understood that debt relief was inevitable, they made it happen. Today many more parties are involved in resolving debt crises of the kind that is affecting Sri Lanka.

Many parties involved

Sri Lanka’s outstanding foreign debt currently amounts to more than $ 37 billion. Of that sum, some $ 12 billion are owed to private bondholders, $ 11 billion to multilateral banks, about $ 9 billion to Chinese institutions and over $ 5 billion to bilateral agencies from other countries. Sri Lanka’s government thus needed to strike agreements with all of them, but lacked a single forum for achieving results. This setting means very cumbersome negotiations because all creditors want to ensure that other creditors do not benefit from any concession they make. It also makes it harder for the indebted government to pit parties against one another.

In late 2022, Wickremesinghe’s government concluded a bailout agreement with the International Monetary Fund (IMF). It went along with rather tough austerity and thus thwarted socio-economic hopes that were expressed in the political uprising. On the upside, it allowed the government to function properly once more, and it also restored investors’ confidence to some extent.

The IMF also obliged Sri Lanka to conclude debt-restructuring agreements. Consecutive tranches of bailout disbursements depend on progress being achieved. As all creditors know that full debt services cannot possibly resume, they have incentives to compromise. Nonetheless, private-sector investors, western governments and creditors from large emerging markets try to make others assume most of the costs, minimising their own losses.

China is a particularly difficult partner

In this context, the People’s Republic of China proved to be particularly difficult. India too is an important bilateral creditor, but it joined Japan, France and other governments in the group called the Official Creditor Consortium (OCC). In late June, the OCC struck a restructuring deal with the Sri Lankan government.

China’s most important bilateral lending agencies are the China Exim Bank and the China Development Bank, but they do not even negotiate with Sri Lanka’s government together. Both banks are state institutions, but the regime in Beijing insists that they are separate entities. While the Exim Bank followed the example set by the OCC with a deal of its own, the China Development Bank is still engaged in talks.

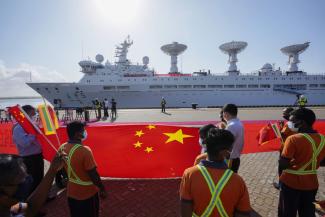

Hambantota Port in South Sri Lanka has become an internationally known example for how sovereign debt can go terribly wrong even before the sovereign default. The harbour and its surrounding infrastructure were built with loans from the Exim Bank. Inaugurated in 2010, however, it generated less container traffic than expected and thus proved to be commercially nonviable. The owner, the Sri Lanka Ports Authority (SLPA), eventually became unable to service the loans. Next, the China Merchants Port Holding Company Limited (CMPort), which belongs to the Chinese government too, purchased the majority ownership of the port, including the right to operate and develop it for 99 years.

Several other projects failed as well, including an airport and a cricket stadium. It mattered quite a bit that Chinese agencies, when lending to foreign governments, do not pay attention to issues of governance. They are generally willing to finance whatever a national government plans. Some vanity projects designed to celebrate the Rajapaksas, however, were useless in business terms and clearly do not serve the common good. Such lending increased Sri Lanka’s sovereign debt which is now weighing down on the people.

The recent agreements Sri Lanka concluded with the OCC and the Exim Bank, however, mean that $ 10 billion worth of loans will now be paid back later than originally planned and at lower interest rates. After the bilateral creditors made concessions, moreover, private bondholders became willing to move as well. In early July, they struck a deal with the Sri Lankan government to extend timeframes, reduce interest rates and even cancel up to 28 % of the debt. Should Sri Lanka’s economy start to grow fast again, however, the government will have to service 85 % of the currently outstanding debt rather than merely the 72 % now agreed.

All these agreements mean that Sri Lanka’s government gets some additional fiscal space, but not the clean slate that debt relief could provide. The agreement with bondholders, moreover, does less to revive the economy than it would if it allowed the government an unencumbered restart.

Things are getting better, but not necessarily good

While much work remains to be done, President Wickremesinghe has certainly achieved considerable progress regarding debt restructuring. The IMF is willing to disburse more bailout money. Ahead of presidential elections due in October, Wickremesinghe can tell voters that things are getting better. According to him, Sri Lanka paid more than nine percent of GDP on foreign debt payments in 2022, and, thanks to the recent bilateral restructuring deals alone, that share will sink to below 4.5 % from 2027 to 2032.

Whether things are actually getting good rather than merely better is a different question. In 2024, debt servicing will still consume more than half of Sri Lanka’s government revenues. Some observers argue that the debt burden remains quite heavy, with payments mostly being postponed and set to become much more onerous again in the not-so-distant future. It also matters that every rupee used for debt services cannot be invested in Sri Lankan policies for achieving the UN’s Sustainable Development Goals.

Sri Lanka’s current experience shows that some kind of international sovereign default mechanism would indeed make sense. It would ensure that all creditors are involved in coherent negotiations to restore solvency to a sovereign government after default.

Establishing a global mechanism, however, requires global consensus – and that looks unlikely at a time when China and western countries are increasingly seeing one another not as partners, but as systemic rivals (see interview with Vannessa Wannicke).

Arjuna Ranawana is a Sri Lankan business journalist.

arjuna.ranawana@outlook.com