ODA

The concept of official development assistance is outdated

Members of the professional community find the term “aid” condescending. For decades, they made efforts to rename it “development cooperation”, but that did not catch on in the wider public. The press still regularly uses “aid” when dealing with ODA.

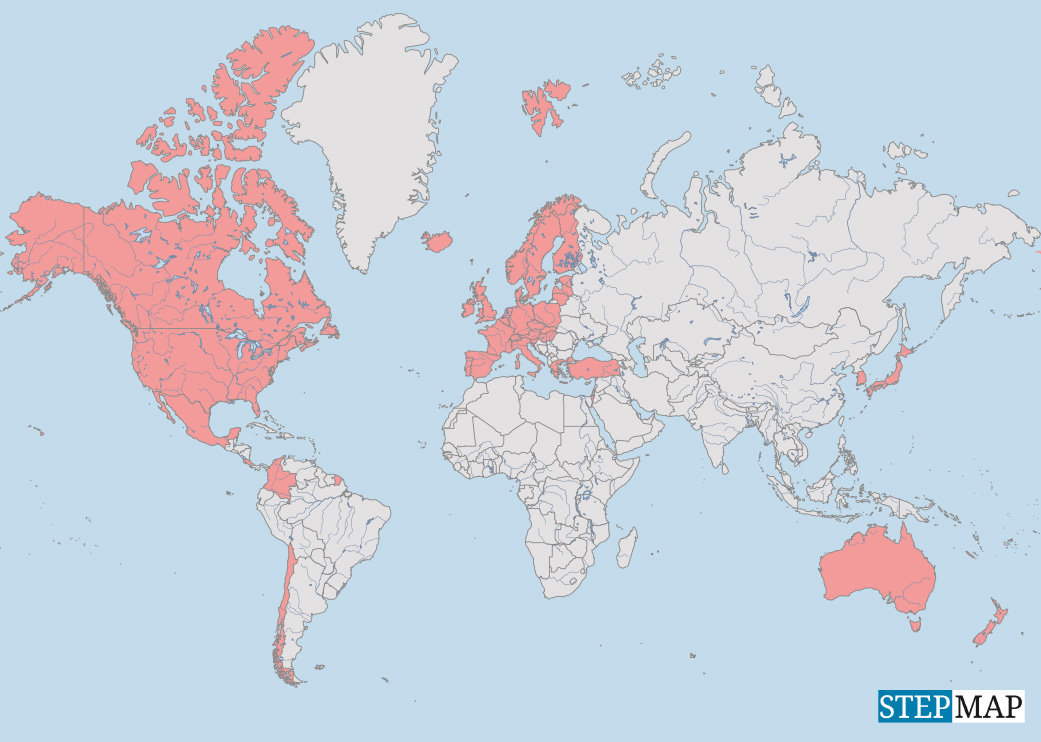

The history of ODA is troubled in other ways too. In 1970, the nations with high incomes pledged to invest 0.7 % of their gross national income (GNI) in ODA every year. The group did not live up to the promise. In 2021, only Luxemburg, Norway, Sweden, Germany and Denmark were true to their word, according to the Organisation for Economic Co-operation and Development (OECD), an umbrella organisation of high-income nations and some emerging markets. Global ODA only amounted to 0.33 % of OECD members’ GNI.

Some argue that this failure does not matter much because other kinds of financial flows – including private foreign direct investments and migrants’ remittances – exceed ODA. When a promise stays unfulfilled for half a century, however, that is a clear sign of dysfunctional politics.

For several reasons, the ODA system is indeed not up to task. They include:

- the tendency to redefine goals over time,

- the growing need to invest ODA money in global public goods and

- disagreements between established economic powers and emerging markets.

ODA was originally meant to support recipient countries’ national development. The idea was that infrastructure investments would drive growth and lead to broad-based prosperity. This approach had facilitated reconstruction in Western Europe after World War II, but it did not work as expected in Africa, Asia and Latin America. Therefore, other topics were prioritised. In the 1990s, the focus was on poverty reduction. Later the rule of law, gender justice and minority rights became prominent.

Not only goals were redefined. The OECD also modified what counts as ODA. Dissatisfaction with ODA, moreover, triggered interesting proposals for more convincing concepts (see box).

Global public goods

The greatest challenges the international community faces are things like climate change or the Covid-19 pandemic, which require the provision of global public goods. Economists call a good “public” when it benefits all stakeholders, regardless of whether they contributed to bringing it about.

Left to market forces alone, public goods remain underfunded. Private parties normally do not invest in them because they do not want others to benefit from their spending, but also hope to free ride themselves. Public infrastructure (including roads, water supply and electric power) therefore depends on public-sector spending and prudent legislation. Without government action, public goods remain neglected.

Funding for global public goods

In this sense, the debate on how to deal with the climate crisis and other global challenges boils down to who will bear what costs for providing global public goods. This is an issue of global governance, and finding international consensus is always difficult. Russia’s invasion of Ukraine has made it even more difficult.

In recent decades, OECD members’ ODA expenditure has increasingly served to bolster global public goods. An example is funding for clean-energy facilities, which serve the dual purpose of national development and global climate mitigation. Dual purpose ODA would be fine in principle, if OECD members contributed their fair share to global purposes in other ways too. They are not doing so.

Unfulfilled climate promises

The failure of the Kyoto Protocol was a striking example. The intention was to turn it into a long-term instrument for predictable emissions reductions, but the prosperous nations did not do so. By mitigating climate change at home, they could have strengthened a global public good.

In 2009, moreover, high-income nations promised to mobilise an annual $ 100 billion for climate action in less advantaged countries from 2020 on. That money was supposed to come on top of ODA. So far, however, they are only affording about $ 80 billion per year, and the terms are so loosely defined that it is impossible to tell climate finance apart from ODA. Last year’s climate summit in Egypt decided to establish a new fund to cover the loss and damage of climate impacts. How such funding will be distinguished from previous pledges remains unclear.

When Covid-19 spread around the world in 2020, there was a general failure of cooperation and even coordination. Governments competed for diagnostic tests, personal protective equipment, ventilators and, from 2021 on, vaccines. Western countries developed the most effective vaccines, but provided them primarily – if not exclusively – to their own citizens. By contrast, China and Russia developed vaccines and shared them with other countries generously.

For many years, western governments have been calling for more private development financing, not least in view of the ambitious 2030 Sustainable Development Agenda. It fits the pattern that they modified ODA rules to include some kinds of such funding. Public-private partnerships have indeed arisen and arguably operate quite efficiently, but there are obvious limits to how much private money can be mobilised for public goods. Profit-maximising companies have other priorities.

OECD versus emerging markets

Emerging market economies grew fast in the past three decades, and from the turn of the millennium on, countries like Brazil, India and China extended their global reach. As their trade expanded, companies from these countries invested abroad, and their governments contributed more to ODA-related efforts. The OECD response was to try to create global rules for development cooperation, but the most important emerging markets did not accept common standards, insisting on their freedom to implement policies of their own. As a result, the aid system became even more fragmented and politicised.

It probably became less efficient too. Shying away from closer cooperation with the OECD meant that China, for example, did not learn from OECD experience. To some extent, the current debt crisis many countries are facing results from China having granted loans with too little concern for corruption or the quality of governance in general. However, China did not cause the problems on its own. Others are culpable too. Private-sector lending to countries with low and middle incomes has increased considerably. Moreover, institutions that are owned or dominated by OECD countries, certainly must bear some responsibility too.

Solving the debt problems will require difficult negotiations involving all creditors. The G20 (group of 20 leading economies) has adopted a Common Framework for Debt Treatment (CF) which is a reasonable starting point, but not yet fully fit for purpose. It is a good example of the international community needing stronger global governance.

To bring it about, better cooperation is needed. If western governments want to make it happen, they must do more to promote global public goods. Criticising authoritarian regimes is simply not enough, even if it is justified.

André de Mello e Souza is an economist at Ipea (Instituto de Pesquisa Econômica Aplicada), a federal think tank in Brazil.

andre.demelloesouza@alumni.stanford.edu

Twitter: @A_MelloeSouza

Correction, 15 February 2023: The original version inaccurately stated that prosperous nations had failed to fulfill their Kyoto Protocol duties. The truth is that the US never signed and others later opted out, Nonetheless, in sum, initial reduction pledges were met, though mostly due to economic crises and collapse of industries rather than serious mitigation efforts that would have made economic activity environmentally sustainable. The inaccuracy was not the author's fault. It happened during the editorial process.