Donor action

Bismarck’s tools for nation-building

Is it true that only prosperous economies can afford to spend government money on social protection and welfare for the poor?

No, it is not. On the contrary, social protection can be a driver of economic development rather than some kind of reward for successful development.

In what sense?

The crucial point is that poor people who do not enjoy any kind of social protection do not invest the little money they save. Most of them make sure that they have some cash in the case of an emergency. However, they would never risk losing that money, and they want to have access to it any time. The savings therefore are not recycled into the economy and accordingly do not result in any interest payments. If, by contrast, people know that an illness or losing their job will not plunge them into total economic despair, they are better able to run risks, for instance, by starting a small business or spending on their children’s education. Without social protection, people don’t like to send their children to school for longer than necessary, and they are reluctant to let them go to college. It seems safer to start earning money as soon as possible. Accordingly, a huge potential for knowledge, skills and start-ups is never tapped.

Market-orthodox leaders warn, however, that social protection can become a kind of hammock that encourages laziness. They also insist that private-sector protection systems like health or life insurance deliver better results than government agencies.

That may be the lesson of some theoretical modelling, but historical experience teaches us something different. The German economy did not suffer when Otto von Bismarck introduced public social health and pension insurance in the 1880s. On the contrary, the policy stabilised the new-founded German Reich, and a long economic boom followed. In a similar way, President Franklin D. Roosevelt’s “New Deal” did not plunge the USA into a depression. It paved the way out of the Great Depression. “Social Security”, as the American pension system is called, was an important element. Social protection is indeed a foundation of modern economies. It matters, moreover, that private-sector protection can fail spectacularly in times of crisis. Because of market failure, the global financial crisis erupted with the collapse of Lehman Brothers, the investment bank, ten years ago. AIF, an American insurance giant, was one of the systemically relevant financial businesses that floundered and had to be bailed out by governments. At the same time, much ridiculed welfare expenditure – including unemployment benefits – ensured that people who lost their jobs did not drop into a void. What is more: in spite of rising unemployment, all households maintained a certain level of purchasing power, so aggregate demand did not decline even further. Economists realised that social protection served as a macro-economic stabiliser.

But a reduction in unemployment benefits considerably reduced unemployment in Germany after 2005, and the ageing of society is overburdening our pensions system. So don’t the market-orthodox critics of social protection have a point?

Well, it certainly makes sense to discuss details of benefit systems and adapt them to changing social circumstances from time to time. That said, it is not enough to reduce unemployment, as we see in Germany. The problem is that we now have many working poor, who have accepted low-pay jobs, but still depend on government support. Moreover, the private-sector investment schemes, which the Federal Government is subsidising to fill the gaps that are showing up in the government pensions system, have not worked out as planned in the past ten years. Extremely low interest rates meant that many citizens’ invested capital has hardly increased at all. For these reasons, many Germans are tense and afraid of social descent. Right-wing populists are benefiting from such feelings, and similar trends are evident in many European countries. Political stability requires social protection, and markets need political stability – which is something they cannot bring about themselves.

Did Bismarck understand the economic relevance of his reforms?

He was probably more concerned with politics. It is well known that he wanted to keep the Social Democrats small and even outlawed the party. He hoped to slow down the labour movement by solving the problems that were making people join it. In this sense, his policy was not very successful. The Social Democrats kept gaining strength. But in another sense, it was very successful. When the German Reich was established in 1871, many people considered themselves to be Württembergers, Bavarians or Rhinelanders, but not Germans. The innovative social-protection systems, however, fostered a new sense of security, and people began to identify with the new order. The Reich gained legitimacy. Today, we would call what Bismarck was doing “nation-building”.

Are there any lessons for our times?

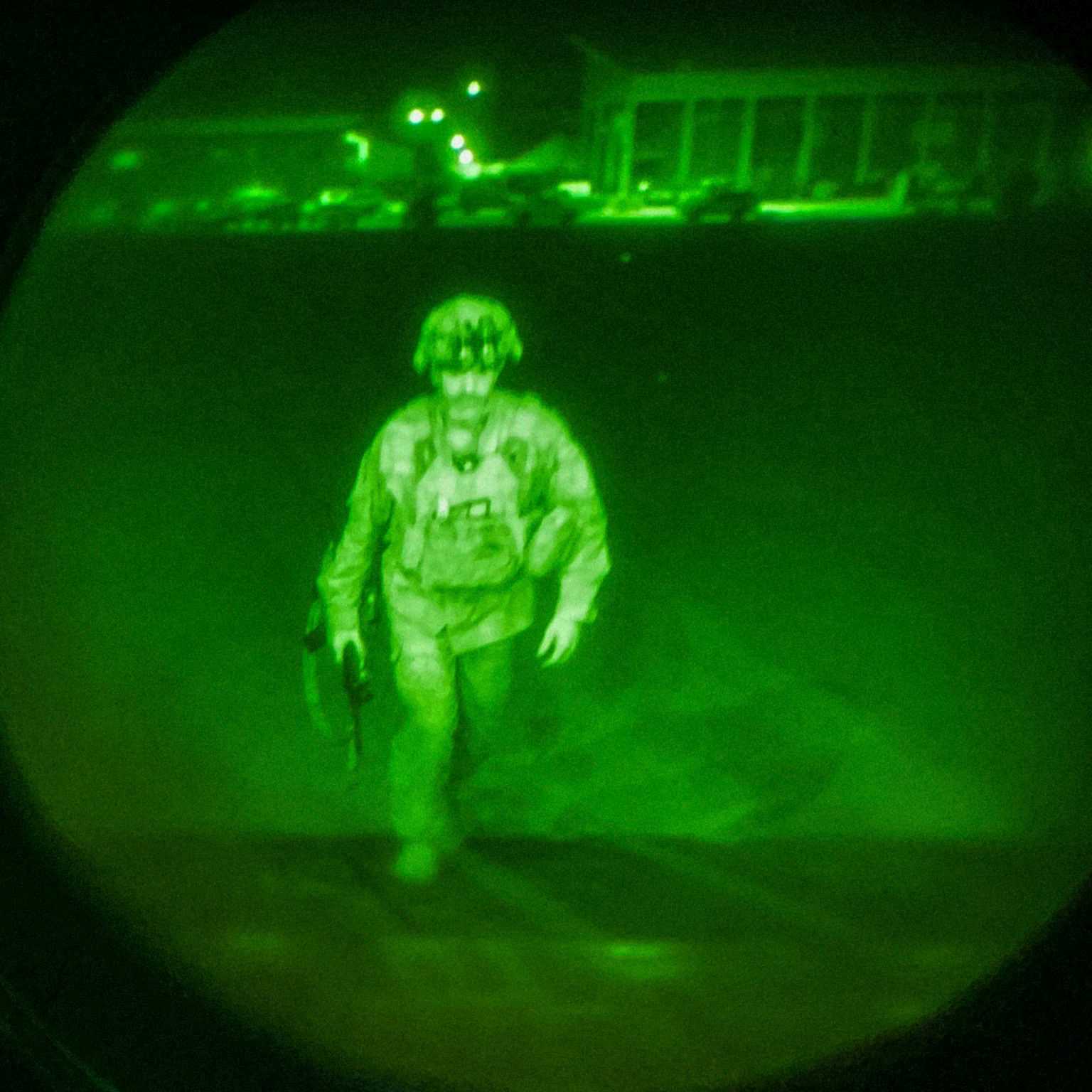

Yes, and especially in regard to post-conflict situations. Donor governments would do well to lend generous support to the establishment of social-protection systems in the places concerned, and to do so fast. After violent strife, masses of people are traumatised, terrified and full of resentment. Some want revenge. A great number of people suffer economic need, while the health and education systems are overburdened. In such settings, the introduction of a guaranteed minimum income or health coverage for everyone can contribute to fostering a new sense of solidarity and nationhood. Moreover, the legitimacy of the new government would get a boost.

Are multilateral and bilateral donors doing enough in this regard?

No, they aren’t. The conventional wisdom, according to which the priority must be to invest in business and physical infrastructure for things to improve again, is still quite strong. The relevance of social infrastructures is systematically being underestimated. And that is so in regard to all low-income countries. The mindset is changing slowly, however. Bolivia, Lesotho, Namibia, Mauritius and Botswana have introduced guaranteed minimum pensions for the elderly. Experience shows that schemes of this kind reduce extreme poverty among senior people considerably. The old are thus less of a burden for their families, so more time, money and care is invested in the children.

Does it make sense to target benefits so they only serve specific groups? Or is it better to invest in universal benefits which are handed out to everyone?

Targeting looks clever, but it is hard to do in practical terms. The related administrative efforts are huge, and still, the typical scenario is that middle classes ultimately benefit just as much as the neediest people do. Universal benefits often deliver better results in terms of distribution. For the poorest they will even amount to meaningful support if they are quite modest. Self-selection can work out, too. If a scheme guarantees a minimum wage for physical work, for example, only those who need the money will apply.

Should benefits be conditional or unconditional?

Well, it is certainly acceptable to ask able-bodied people to do something in return, but benefits for children and the aged should be unconditional. Some countries – Mexico and Brazil, for example – tie a family’s benefits to conditions that the children must go to school and be vaccinated. Such rules should not be enforced too stringently. If a family loses its benefits too fast, that does not help anybody. Research, moreover, has shown that most parents have a clear understanding of what is good for their children, so the conditions don’t really make a difference. That said, some mothers appreciate the conditions because they bolster their bargaining position in discussions about the household budget.

Experts distinguish tax-funded protection systems from contributory ones. The first are included in the national budget. That is the case in Britain and Scandinavian countries, for example. Bismarck, by contrast, funded specialised, government-run insurance systems with compulsory contributions that were linked to a person’s wage level. This model has been copied in France, Italy and the USA for example. In the USA, the contributions are called “payroll taxes” and serve to fund Social Security and related services. Which approach is better: funding from the general budget or from contributions tied to wages?

Both models have upsides and downsides. The main downside of the payroll system is that it only works well in the formal sector. In some African countries, however, 90 % of the livelihoods are in the informal sector, so the people concerned cannot be easily covered by the payroll system. Programmes funded from the national budget can reach them, however. Non-contributory systems can be progressive: they charge economically potent people more, while the poorest do not have to contribute at all – at least if direct taxes are the government’s main source of income. Up to a certain income level, by contrast, payroll systems apply the same fixed rate to all contributors. The two implications are that:

- non-contributory systems are more effective in terms of keeping inequality in check, but

- they are harder to implement for political reasons.

Contributory schemes often become much larger, redistributing much more money than non-contributory systems. Size matters. On the other hand, it is obvious that budget funding is necessary where the informal sector is large. It is telling that the World Bank demands that governments provide tax-funded universal social protection. According to its latest World Development Report (summarised in box, page 30, the editor), that is needed to cover the informal sector, and because artificial intelligence, robotics and automation are making labour relations more informal in many business sectors. The point is that the stability of societies depends on everyone being included, regardless of their employment status. It is obvious, in any case, that the UN Sustainable Development Goals cannot be achieved without prudent social-protection policies.

Poverty and inequality transcend borders. Does that mean that we need something like international social-protection policies?

That has often been proposed. There are basically two options: more prosperous countries could subsidise social protection in poorer ones, or multi-country payroll systems could be created. Both would be politically very hard to implement in view of strong opposition. To a rather small extent, however, donor governments have already begun to subsidise social protection in developing countries. More should be done. Social expenditure is indeed an investment in strengthening the economy and stabilising the political system. I find it exciting, moreover, that the World Bank is set to propose something like a global universal guaranteed income in view of artificial intelligence, robotics and automation.

Markus Loewe is a senior researcher at the German Development Institute (Deutsches Institut für Entwicklungspolitik – DIE).

markus.loewe@die-gdi.de