Our View

Close funding gaps

There is no doubt in international discourse that development finance must improve in order to become commensurate with current crises. The climate crisis, the erosion of biodiversity, the lingering impact of Covid-19 and wars are issues that transcend national borders, all too often with global impacts. The international community is far from fulfilling its ambitions. That became soberingly evident in this year’s half-time stock-taking of the Sustainable Development Goals (SDGs). SDG1, the eradication of extreme poverty, has probably become unachievable by 2030.

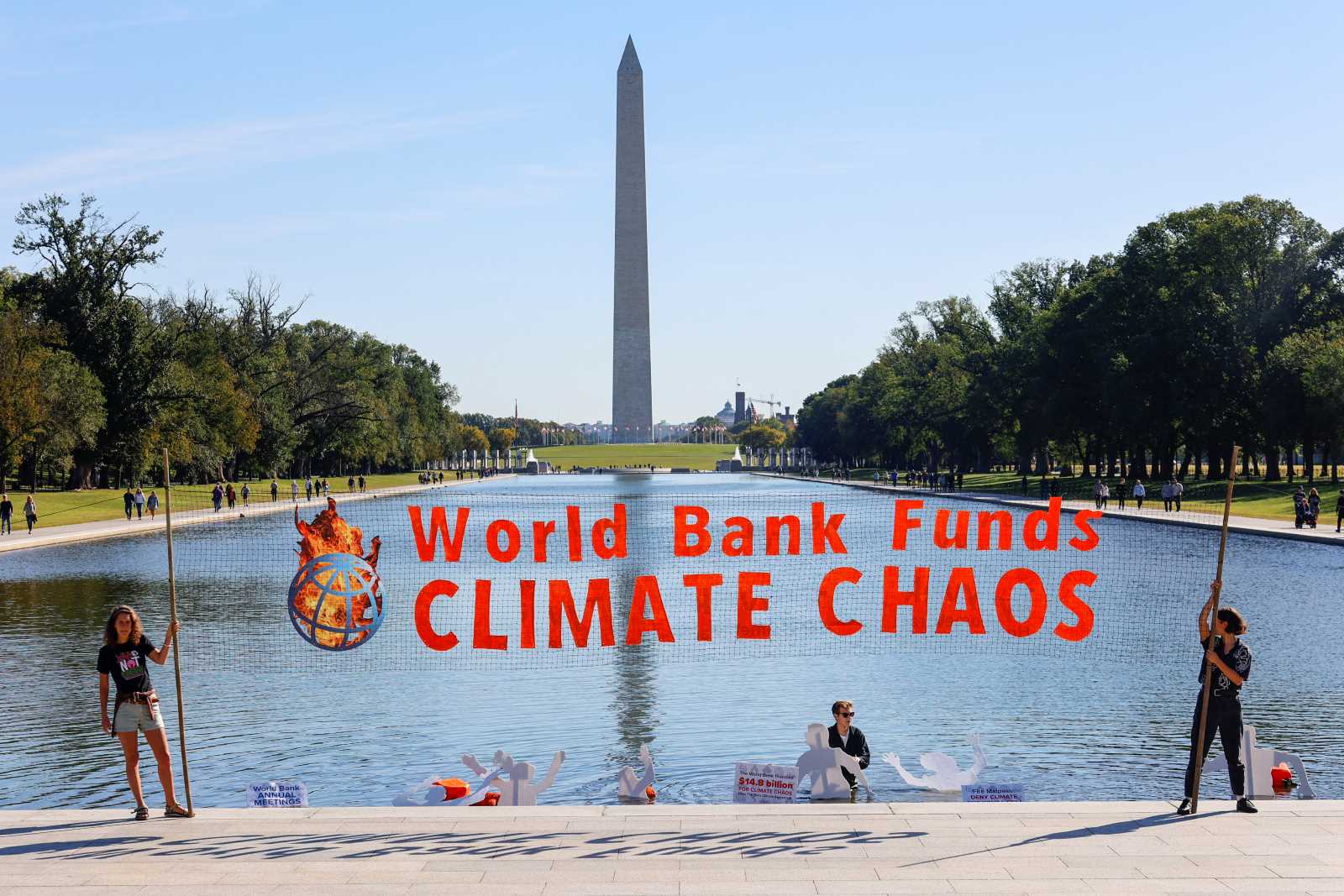

To get as close to the goals as possible, countries with low average incomes need more loans and more concessional money from multilateral development banks. It is therefore good news that the World Bank and regional development banks recently agreed to improve cooperation, expand financial capacities and act in a faster and more flexible manner.

The World Bank is the largest of these institutions and therefore matters in particular. It is often perceived as too bureaucratic, inflexible and cautious. Shareholders including the USA and Germany launched its reform process last year. The standard bearer of change is Ajay Banga, who became the Bank’s president in June. He spelled out his vision at the annual meetings of the World Bank and International Monetary Fund in Morocco in October. The core mission is still to fight poverty and boost prosperity, but the newly declared aspiration is to make that happen “on a liveable planet”. Banga thus wants to pay more attention to the above-mentioned global challenges. In his eyes, they blend into one another and cannot be distinguished precisely.

That is true. The big global crises are indeed mutually reinforcing. The climate crisis threatens food security; environmental destruction makes pandemics more likely; wars displace masses of people and can lead to rising food and energy prices. Getting a grip on one crisis thus helps to contain others. Synergies of this kind must be grasped.

So yes, the World Bank should indeed respond to crises in a comprehensive manner. It would also do well to mobilise more funding and to allocate resources faster. Banga’s plans include somewhat more risky operations and more leveraging of private-sector investments. Success would make the World Bank a role model for other multilateral institutions.

Quite obviously, low-income countries must get more money, both from established economic powers and the emerging markets that are now on the threshold of high-income status, as China is, for example. Low-income countries’ worries are growing faster than their economies. They did not cause problems like global heating, so they deserve support from those who are responsible. Options include multilateral and bilateral approaches.

A first measure of Banga’s success will be whether he can mobilise more money for the World Bank. Low-income countries find the next replenishment of IDA, the International Development Association, particularly important. This branch of the World Bank Group finances projects in countries with a gross national income per capita of $ 1,315 or less. In the period 2022 to 2025, IDA has $ 93 billion. How much money will be available in the next period will be decided in 2024. Banga needs a record sum.

Even if he gets it, however, it will not suffice to close SDG funding gaps. According to the UN, developing countries face a financing gap of $ 4 trillion for relevant investments. Moreover, almost 40 % of the countries concerned are struggling with serious debt problems. More funding is needed from strong economies and the private sector. Moreover, excessive debts must be restructured in a fair manner, so disadvantaged countries get real development opportunities.

Jörg Döbereiner is a member of D+C/E+Z’s editorial team.

euz.editor@dandc.eu