Global warming

Disaster statistics

In early January, Munich Re published its disaster statistics for 2012. According to the multinational giant, 60 % of the damages worldwide were not insured, with insurance coverage typically lacking in developing countries and emerging markets. The re-insurance corporation counted a record number of 900 catastrophes last year. However, the sum of damages was considerably below the record level of $ 400 billion registered in 2011, according to the data. The reasons included the triple disaster of earthquake, tsunami and nuclear accident in Japan in 2011 and an earthquake in New Zealand, which led to huge costs.

In 2011, 27,200 people died because of natural disasters, according to Munich Re, and the number dropped to 9,600 last year. In humanitarian terms, Taiphoon Bopha, which hit the Philippines in December, was the worst disaster in 2012. It killed more than 1,000 people, as the statistics show, and many are still missing. The insured damage, however, was relatively small, which is typical of societies where many poor people have no money to spare for insurance policies.

In financial terms, Hurricane Sandy was the worst disaster last year. Munich Re estimates that it caused damages worth $ 50 billion when it hit the US east coast in October. The re-insurance’s press release does not elaborate Sandy’s financial consequences in the Caribbean, where the storm raged before reaching the USA. The document does state, however, that 80 of 210 people killed by the storm lived on Caribbean islands.

Examples of what to expect in the future

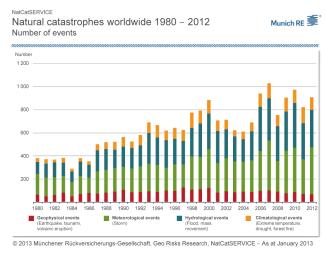

The second most costly disaster last year was the draught in the mid west of the USA, where damages amounted to $ 20 billion, according to Munich Re. In the eyes of Peter Höppe, who heads the corporation’s geo-risk research, Hurricane Sandy and the draught are examples of “what kind of events we must expect in the future.” Munich Re argues that climate change is a “crucial” contributor to the trend of ever more frequent disasters. Indeed, the number of weather-related catastrophes grew considerably in past decades, whereas the number of geo-physical events such as earthquakes or volcano eruptions has not changed much (see graph). Höppe predicts there will be more draughts and severe storms in the future. Moreover, he says that higher temperatures and the rising sea level will make coastal flooding more likely. His conclusion is that preventive action must be taken fast.

Whether people buy insurance policies depends on their economic situation. Most relevant risks are covered in highly developed world regions, according to Munich Re, whereas the growth potential for insurance companies is huge in the developing world. Munich Re estimates that only 10 million of the 4 billion people who must cope with less than two dollars purchasing power per day are covered by some kind of insurance.

It is consensus in multilateral talks that developing countries must adapt to the impact of climate change, and that the advanced nations must help them do so. In the eyes of Munich Re, micro insurances could play a role by protecting poor people from the financial consequences of weather-induced calamities. The Alliance of Small Island States (AOSIS) has been discussing such ideas since the 1990s, and it expects rich nations to pay the bill.

Munich Re is currently designing an insurance scheme to protect farmers from draught. The idea is to take account of precipitation and disburse insurance payments if rainfall stays below a certain threshold. Such an insurance would serve rural people well when their harvests fail, which is becoming ever more likely due to global warming. Sandra Abild