World economy

Multilateral order faces toughest test since World War II

Globalisation in the sense of ever-increasing world economic integration looked like a force of nature in past decades. That was then. The Ukraine war may indeed sound its death knell. Even Christine Lagarde, the president of the European Central Bank (ECB) and former top leader of the International Monetary Fund (IMF), has cast doubt on the future of an integrated global economy. Two years ago, the prominent economist Carmen Reinhart declared she expected coronavirus to put the last nail in the coffin of the globalisation era.

There are other doomsayers, and serious snags in international supply chains support their predictions. Indeed, policymakers are once again focusing more on national and regional advantages. The pandemic reinforced a more nationalistic approach to the provision of essential goods. The trend may lead to the “deglobalisation” of the world economy and reduce its growth potential.

A wave of distrust

The Ukraine war, moreover, has triggered a wave of distrust, aggravated after western governments imposed unprecedented sanctions on Russia. Central banks froze Russian assets and some Russian banks were disconnected from the vitally important SWIFT transfer system. To some extent, these steps amounted to an economic declaration of war. No matter how they assess the Russian invasion of Ukraine, governments of emerging-market nations now worry that they themselves may at some point be targeted by similar action coordinated by western high-income countries.

The current situation is indeed worrisome. After the Cold War, fast growing global trade and deregulated financial services created strong international connections. This system is now on the verge of collapsing. Financial stability is at risk around the world, and a global recession is likely.

For decades had globalisation expanded at a solid pace – helped by pro-market policies, fast technological change and favourable geopolitical trends. In 2008, the collapse of Lehman Brothers, a New York-based investment bank, brought the world economy to a standstill. The ensuing global financial crisis cast doubt on the promise of ever-expanding trade and prosperity.

G20 – then and now

The leaders of the world’s 20 largest economies (G20) cooperated with an eye to preventing a global depression with coordinated stimulus programmes. Emerging markets were not affected dramatically and could serve as locomotives of recovery. Their potential role was appreciated by western leaders. However, the recovery proved excruciatingly slow in high-income countries, and the euro crisis added to problems.

In retrospect, one can say that the G20 managed to prevent a global depression in 2008/09, but the members soon reverted to more narrow-minded nationalistic approaches. In particular, the rivalry between the USA and China became more harmful.

Today, the G20 seem like a spent force, not least in view of disputes regarding whether Russia should still participate. The need for global governance, however, is arguably now bigger than ever.

Back to Bretton woods

In reaction to Covid-19 and the escalating climate crisis, Kristalina Georgieva, the IMF’s current top leader, spoke of “another Bretton Woods moment” in 2020. She was alluding to the conference in Bretton Woods, the small US town, where diplomats had decided to create the IMF and the World Bank at the end of World War II. They wanted to make sure economic disasters like the great depression of the 1920s/1930s would never happen again (see Hans Dembowski on www.dandc.eu). The new multilateral agencies would use pooled resources to support national economies in crisis in ways that would prevent a global depression.

In 2020, Georgieva’s point was that Covid-19 was challenging the notion of global interconnectedness and interdependence. It spread fast internationally. Governments closed borders. The governments of high-income nations responded with massive spending on health care, social protection and economic stimulus programmes. Georgieva pointed out that the climate crisis required equally determined responses – and that governments with little fiscal space had to be enabled to act too. Her message was thus that more, not less government spending was needed (see my contribution on www.dandc.eu).

She emphasised the necessity to invest in health care and other social services, sustainable infrastructure and building human resources. The implication was that the IMF now worried more about these things than about growing government debts. The paradigm shift away from austerity and strict budget controls towards more state interventionism had been becoming increasingly evident since the financial crisis.

Unresolved issues of the global financial architecture

David Malpass, the president of the World Bank, basically endorsed Georgieva’s views in 2020. He spoke of the urgency of “addressing poverty, inequality, human capital, debt reduction, climate change and economic adaptability as elements in ensuring a resilient recovery.” In theory, a coordinated global effort is possible. Whether it is politically feasible, is an entirely different question. Indeed, many issues regarding the global financial architecture must yet be sorted out, including conditions for debt relief (see Kathrin Berensmann on www.dandc.eu) but also equitable climate finance and effective development assistance.

In retrospect, the economic slump caused by Covid-19 was not as bad as feared. The oil price briefly dropped below zero, and stock markets crashed around the world. They rebounded fast, however, and the main reason was that stimulus programmes of many different countries basically addressed the same problems with similar means at the same time. In effect, that added up to a huge global programme. It ultimately even proved excessive, with inflation spiking as lockdowns ended.

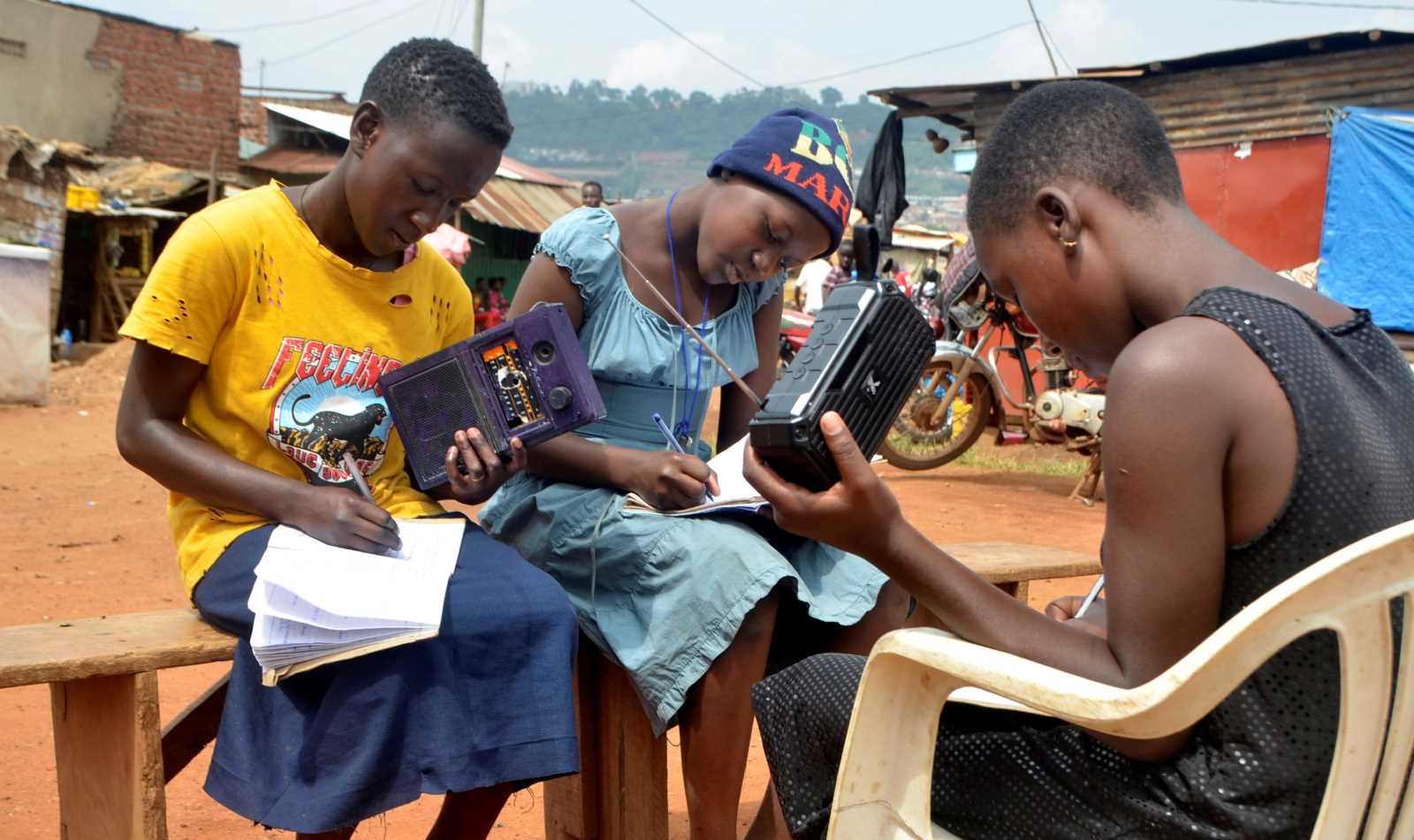

The lack of global cooperation had other serious impacts as well. Nations with little fiscal space could not afford stimulus programmes, and the G20’s temporary suspension of debt servicing did not make a big difference. The unequal distribution of medical supplies was frustrating too. Once vaccines became available, that applied to them as well. In many ways, low and middle income countries were left behind.

Global system still in crisis

International disparities have increased, and important supply-chains have not been restored. The global system is obviously still in crisis. The Ukraine war is adding to the problems. Combined with high inflation, volatile stock markets and lingering Covid-19 issues, it adds up to an explosive mix, and the increasingly devastating impacts of climate change are making it even more combustible. Georgieva now speaks of a “potential confluence of calamities” as the global economy faces its “biggest test since the Second World War.”

Global problems need global solutions. International cooperation is indispensable. National political systems and core values certainly vary significantly around the world, but they must not distract policymakers from the global common good. Multilateral institutions are important, but they are only as strong as national governments allow them to be.

USA and China must lead

The revival of a constructive US-China dialogue is essential. Together, the two superpowers can provide leadership. Mature cooperation may look unlikely at the moment, but it is possible. Both countries have benefited spectacularly from globalisation. Their leaders know that their nations have much to lose from further global disintegration. It may help to focus minds, moreover, that Chinese lending contributed to the over-indebtedness of a number of countries in Asia, Africa and Latin America, so those issues cannot simply be blamed on the west. The meltdown currently paralysing Sri Lanka (see Arjuna Ranawana on www.dandc.eu) is likely to be replicated in other places.

It is promising, moreover, that China is neither supporting nor challenging the western sanctions on Russia. There should thus be scope for cooperation on matters that concern all. Preventing a massive global food crisis tops the list. Uncertainty and fragmentation will be especially painful for low and middle-income economies.

Quite clearly, the international architecture of political relations needs to be rebuilt. In doubt, nations should press ahead in alliances tackling common causes even if not all major powers participate. Climate change remains a pressing threat that recognises no borders. Well defined rules for security, trade, investment, technology transfer and clean energy are essential – for each and every nation.

José Siaba Serrate is an economist at the University of Buenos Aires and at the University of the Centre for Macroeconomic Study (UCEMA), a private university in Buenos Aires. He is also a member of the Argentine Council for International Relations (CARI).

josesiaba@hotmail.com